This page provides information and detail about portions of Illinois’ bonded indebtedness, as well as a look at the state’s bond ratings. For more information on all bond issuances, view Illinois’ Bonded Indebtedness and Long-Term Obligations Report.

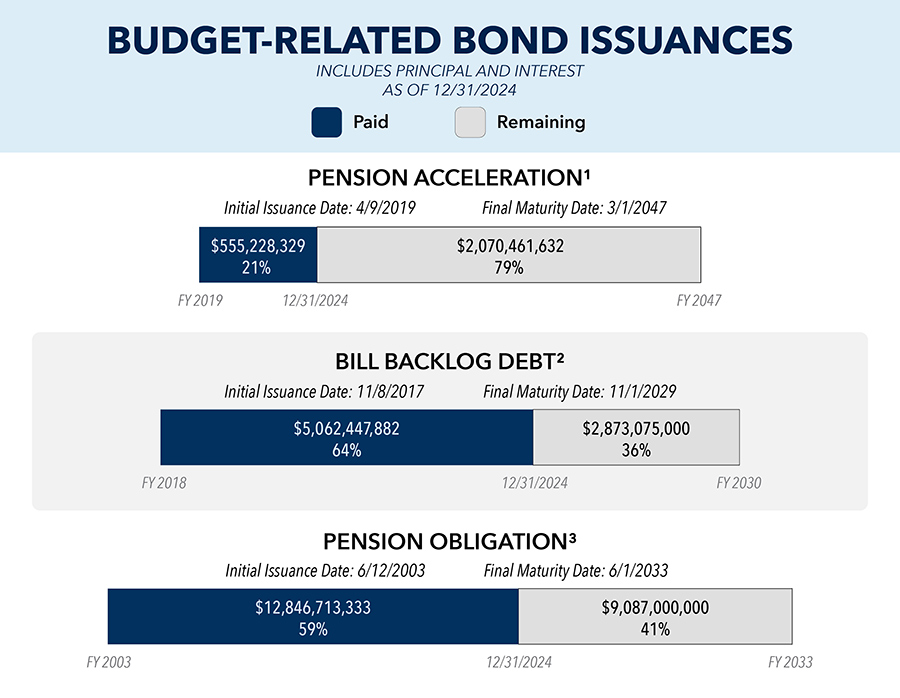

On this page, a special focus is placed on three bond issuances related to past budget developments authorized by previous General Assemblies.

When debt is issued by the government, independent credit rating agencies attach a rating to the issue. The ratings attached to all bonds associated with the State of Illinois affect interest payments and the cost to Illinois taxpayers. Individual bond ratings will vary, but the general and special obligation bond ratings are directly related to financial condition of the state government.

General Obligation

positive outlook

stable outlook

stable outlook

Special Obligation

positive outlook

stable outlook

stable outlook

Total Outstanding Bonded Indebtedness

as of December 31, 2024

$40,424,563,000

(includes principal and interest payment for General Obligation bonds and Special Obligation bonds)

1Pension Acceleration Bonds

The fiscal year 2019 budget implementation bill, Public Act 100-0587, included a new provision allowing the state to issue bonds for the purpose of funding pension buyouts. Under the plan, retiring Tier 1 state workers, teachers and university employees may elect to receive a lump-sum buyout in exchange for future annual cost of living adjustments. Former employees who are vested may elect to receive a total lump-sum buyout in exchange for any pension benefit they would have received in the future. The success of the buyouts has resulted in two extensions of the original 2018 authorization. Presently, bonds may be issued for these buyout plans through June 2026. These bonds have multiple issuances and therefore have various maturity dates, from December 2028 through March 2047. To date, $1.8 billion of $2.0 billion authorized has been issued.

2Paying Down Illinois' Record Bill Backlog

In November 2017, the state received nearly $6.5 billion in proceeds from its $6 billion General Obligation bond sale authorized by Public Act 100-0023 to pay vouchers incurred prior to July 1, 2017. These proceeds helped to cut the state’s unpaid bill backlog by $7.5 billion in only three weeks. By paying billions of dollars in bills that had been accruing interest penalties at between 9% and 12% a year, the IOC helped to save state taxpayers an estimated $4 billion to $6 billion in interest costs through 2029. Of the $6 billion issued, an estimated $2.9 billion in principal and interest is scheduled to be paid by the maturity date of November 2029.

3Pension Obligation Bonds

Approved in April 2003, Public Act 93-0002 authorized the issuance of $10 billion in pension obligation bonds, a portion of which was used to fund the fiscal year 2003 state pension contribution and all of the fiscal year 2004 state contribution. The law included a provision that reduces the annual state contribution by the debt service owed each year. Of the $10 billion issued, an estimated $9.1 billion in principal and interest is scheduled to be paid by the maturity date of June 2033.